Joe Gallick, senior vice president of sales at Penske Logistics, said a challenging economy lends itself well to 3PLs as companies realize the need to leverage assets to be “agile and flexible and to consider different modes.” He added, “modal shift is something we see quite regularly.”

Gallick, along with other industry executives, spoke in a panel discussion at the National Press Club in Washington, D.C., following the release of the 23rd Annual State of Logistics Report, introduced by the Council of Supply Chain Management Professionals (CSCMP) and presented by Penske Logistics on June 13.

Gallick, along with other industry executives, spoke in a panel discussion at the National Press Club in Washington, D.C., following the release of the 23rd Annual State of Logistics Report, introduced by the Council of Supply Chain Management Professionals (CSCMP) and presented by Penske Logistics on June 13.

Rosalyn Wilson, senior business analyst at Delcan and the author of the report, said the third party provider and forwarding sector of the economy was up 9 percent and gaining strength at the end of 2011.

Wilson said U.S. business logistics costs rose 6.6 percent to $1.28 trillion in 2011. In addition, transportation and inventory carrying costs increased in 2011. Transportation costs increased 6.2 percent due to higher rates, while inventory carrying costs increased 7.6 percent due to higher costs for taxes, obsolescence, depreciation and insurance.

Capacity within the trucking industry has continued to tighten, due in part to increased regulations, such as Compliance, Safety and Accountability. New hours-of-service regulations that take effect in July 2013 will reduce the number of hours a driver can work, further tightening capacity. What’s more, many companies are having a hard time finding drivers.

“By the end of 2011 about 18 percent of carriers surveyed by TCP reported 6 to 10 percent unseated trucks,” Wilson said.

Wilson cautioned attendees that capacity will remain tight. "I urge everyone to begin making contingency plans for the day you cannot get a truck," Wilson said. "The railroads are standing by with a great offer and have the capacity to take up the slack."

Interview with Penske Logistics' Joe Gallick

Interview with report author Rosalyn Wilson

Interview with moderator Rich Thompson

Trucking companies are already partnering with rail to avoid problems caused by the driver shortage and to avoid the cost of acquiring new equipment or put off replacing older equipment, the report said.

Freight volumes for trucking and rail increased in 2011. Trucking, which comprises 77 percent of the transportation component, posted a 6.2 percent rise, while the railroad sector saw a 15.3 percent increase. Intermodal volume throughout 2011 increased 5.4 percent to 11.9 million containers and trailers.

“It is becoming a more preferred method of moving goods,” Wilson said.

John Lanigan, executive vice president and chief marketing officer at BNSF Railway, said the company’s domestic intermodal growth is up double digits.

To help facilitate efficient intermodal movements, BNSF is purposely building its newest intermodal facility in Kansas City outside of town so there is room for companies to build distribution centers near it. “These thousand-acre industrial parks are selling out in four to five years of us opening up a new intermodal facility,” he said.

Technology is also changing how goods are moved. Greater data is available and warehouse and transportation management systems can analyze the information to streamline operations.

Gallick (photo on right) said there has been more emphasis on optimizing the movement of goods, including improved layout and design of warehouses. “It is about optimization within the four walls,” he said.

Gallick (photo on right) said there has been more emphasis on optimizing the movement of goods, including improved layout and design of warehouses. “It is about optimization within the four walls,” he said.

Route optimization and efficient use of labor within the warehouse is also improving the movement of goods.

Rick Slather, vice president of customer supply chain for North America consumer products for Kimberly Clark, said information sharing is changing the way many companies operate.

“The new world is forcing us to collaborate because we have to show higher service levels with lower inventory,” Slather said.

Here is a sampling of early media coverage of the report:

By “Move Ahead” Staff

“I like the challenge of trying to create elegant art out of ordinary energy sources and materials, and create something that isn’t usually regarded in the art world. The back of the truck seemed like the perfect place for that kind of challenge,” said Ford, who visited Penske’s headquarters in Reading, Pa., in mid-June to display his work in progress and meet with its employees.

“I like the challenge of trying to create elegant art out of ordinary energy sources and materials, and create something that isn’t usually regarded in the art world. The back of the truck seemed like the perfect place for that kind of challenge,” said Ford, who visited Penske’s headquarters in Reading, Pa., in mid-June to display his work in progress and meet with its employees. Today, Ford uses the entire back of a Penske rental truck to create his artwork. Ford’s pit stop at Penske’s headquarters was part of a commissioned trip by Packer Schopf Gallery of Chicago to showcase his truck drawing at the 8th annual Guerrilla Truck Show at Chicago’s Fulton Market June 12. Ford drove round-trip from Chicago to Philadelphia, where he displayed his art in progress during an event, before returning to the Windy City to show off the final creation.

Today, Ford uses the entire back of a Penske rental truck to create his artwork. Ford’s pit stop at Penske’s headquarters was part of a commissioned trip by Packer Schopf Gallery of Chicago to showcase his truck drawing at the 8th annual Guerrilla Truck Show at Chicago’s Fulton Market June 12. Ford drove round-trip from Chicago to Philadelphia, where he displayed his art in progress during an event, before returning to the Windy City to show off the final creation.

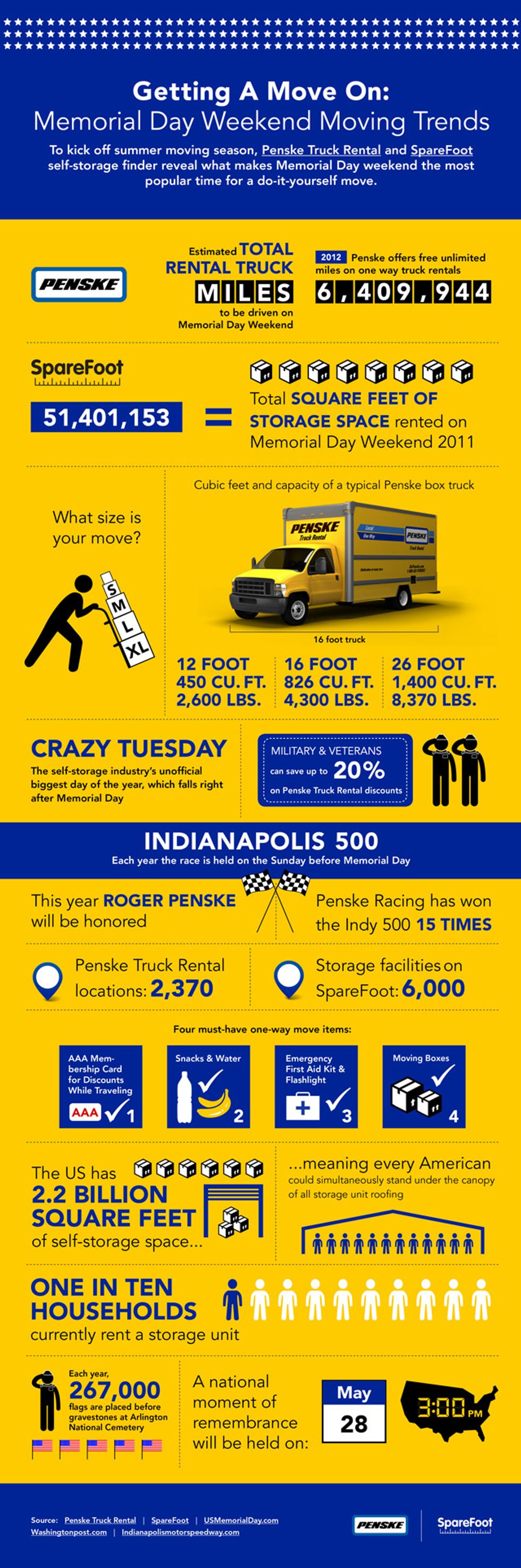

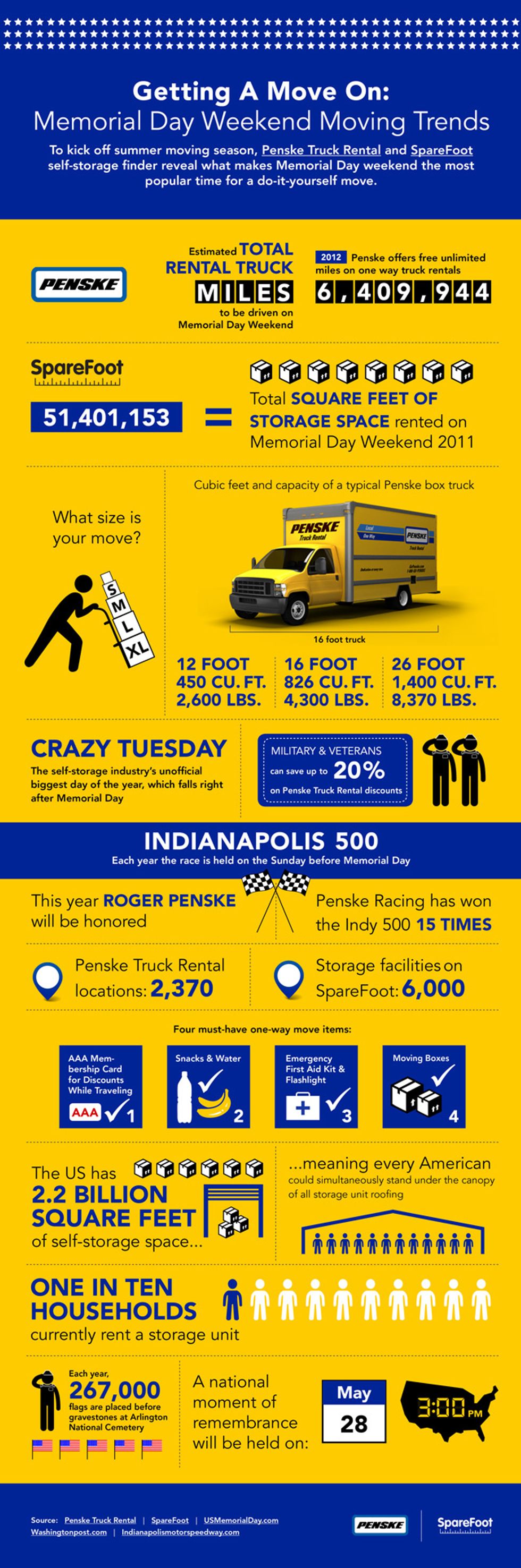

The arrival of summer is a sure sign that the busy moving season has begun.

The arrival of summer is a sure sign that the busy moving season has begun. Q: Can I tow my car?

Q: Can I tow my car?

Penske associates Susan Cosman, Jillian Cosman and Mike Ward, from the Burnaby, British Columbia, location, participated last month in the

Penske associates Susan Cosman, Jillian Cosman and Mike Ward, from the Burnaby, British Columbia, location, participated last month in the  In a basic “pull-a-name-from-a hat” technique, Schappert selected mother-daughter duo Susan and Jillian Cosman and Ward to represent Penske as medal-bearers in the ¼ km relay in Agassiz, British Columbia.

In a basic “pull-a-name-from-a hat” technique, Schappert selected mother-daughter duo Susan and Jillian Cosman and Ward to represent Penske as medal-bearers in the ¼ km relay in Agassiz, British Columbia. Schappert met Hansen during a fundraising gala and concert following the tour. Featuring several big-name Canadian artists, the concert will air on Canadian broadcast, CTV, on June 24.

Schappert met Hansen during a fundraising gala and concert following the tour. Featuring several big-name Canadian artists, the concert will air on Canadian broadcast, CTV, on June 24.

Gallick, along with other industry executives, spoke in a panel discussion at the National Press Club in Washington, D.C.,

Gallick, along with other industry executives, spoke in a panel discussion at the National Press Club in Washington, D.C.,  Gallick (photo on right) said there has been more emphasis on optimizing the movement of goods, including improved layout and design of warehouses. “It is about optimization within the four walls,” he said.

Gallick (photo on right) said there has been more emphasis on optimizing the movement of goods, including improved layout and design of warehouses. “It is about optimization within the four walls,” he said.

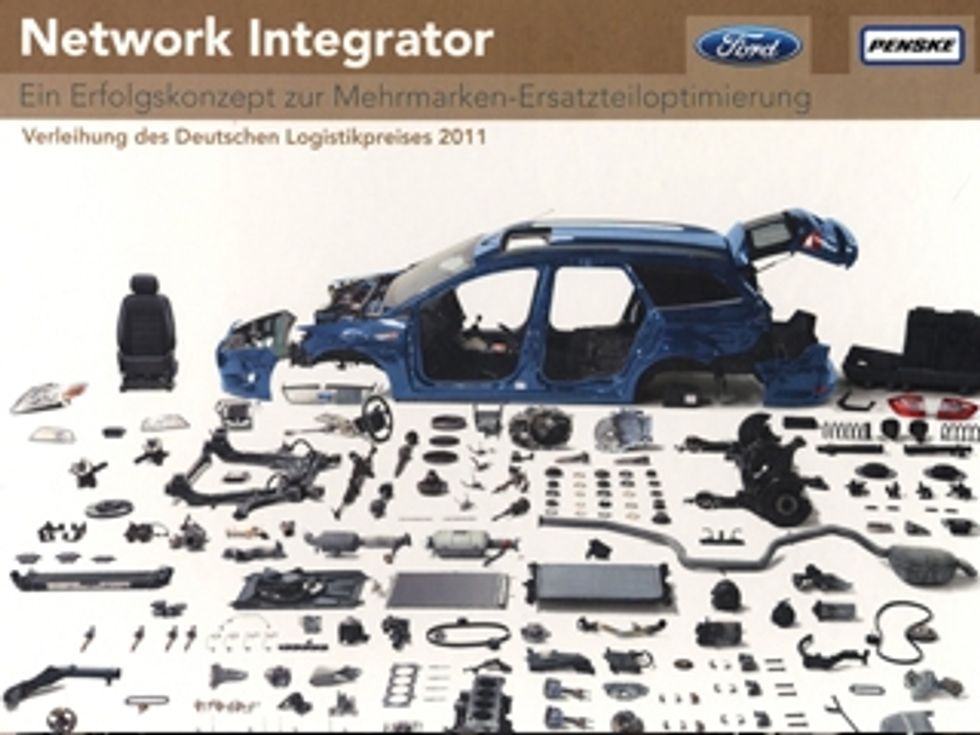

Innovative Concept Helps the Environment

Innovative Concept Helps the Environment “Simply excellent” were the words the European Logistics Association’s judges used to describe the project. “Redesigning a spare parts supply chain is not an easy task, but combining this with the acquisition of other brands to be included in the logistics network in Europe is a true challenge. This supply chain is particularly complex, due to the high number of unique items to be managed, the heterogeneity of those items, and the extremely short lead times that dealers require. The industrywide cooperation makes the Network Integrator a state-of-the-art example. This excellent concept produces excellent results in cost reduction, increased customer service and advantages for the planet through deep collaboration. On top of that it delivers several exemplary models for the future,” the case study judges wrote.

“Simply excellent” were the words the European Logistics Association’s judges used to describe the project. “Redesigning a spare parts supply chain is not an easy task, but combining this with the acquisition of other brands to be included in the logistics network in Europe is a true challenge. This supply chain is particularly complex, due to the high number of unique items to be managed, the heterogeneity of those items, and the extremely short lead times that dealers require. The industrywide cooperation makes the Network Integrator a state-of-the-art example. This excellent concept produces excellent results in cost reduction, increased customer service and advantages for the planet through deep collaboration. On top of that it delivers several exemplary models for the future,” the case study judges wrote. Spare parts logistics has become more challenging for the automotive industry in Europe due to the increasing number of spare parts as a result of increased vehicle complexity. Ford collaborated with Penske Logistics and co-developed the Network Integrator concept into a best-in-class model in industry collaboration.

Spare parts logistics has become more challenging for the automotive industry in Europe due to the increasing number of spare parts as a result of increased vehicle complexity. Ford collaborated with Penske Logistics and co-developed the Network Integrator concept into a best-in-class model in industry collaboration. “Our goal is to continue expanding the concept and encourage other companies of the automotive industry to join the Network, and further leverage economies of scale – to the benefit of each partner participating in the Network and to the environment," Damerow continued. "Last but not least, the customer benefits as well, as we can provide the highest service level through a stable network."

“Our goal is to continue expanding the concept and encourage other companies of the automotive industry to join the Network, and further leverage economies of scale – to the benefit of each partner participating in the Network and to the environment," Damerow continued. "Last but not least, the customer benefits as well, as we can provide the highest service level through a stable network."